Manage Expenses Smarter with the Right Software

Track, control, and simplify your business expenses with top-rated tools — all in one place.

Excellent

-

Popular

Based on the past month

8.6 -

Review score

Based on Trustpilot

8.6

Equals Money

377 reviews On

- Unlimited users on every plan

- Save 17% with annual billing

- Spend in 21 currencies - no FX fees

- Sync with Xero & Concur®

Excellent

-

Popular

Based on the past month

8.6 -

Business Account

100% Without Obligation See the current offers

Excellent

-

Popular

Positive reviews

8.2 -

Brand reputation

Good for SMEs and freelancers

8.2

Capture Expense

- Maximum duration is 36 months

- No collateral is required

- 2.95% closing costs

Excellent

-

Popular

Based on the past month

8.2 -

Business Account

Start? See the current offers

Excellent

-

Popular

Reputation among SMEs

8.5 -

Reviews

Based on 265 Reviews

8.5

Payhawk

265 reviews On

- Real-time spending control

- Easy integration

- No hidden fees

Good

-

Popular

Based on the past month

8.5 -

Business Account

Pleo

1,237 reviews On

- Fast online application

- No fixed interest rate

- No startup costs

Excellent

-

Popular

Based on the past month

8.4 -

Business Account

Curious? See the current offers

Find the Best Expense Management Software for Your Business

- Thoroughly researched and reviewed

- Explore a selection of top-rated expense tracking tools

- Easily compare features, pricing, and customer feedback

Excellent

-

Popular

Reputation among SMEs

8.6 -

Reviews

Based on 1250+ Reviews

8.6

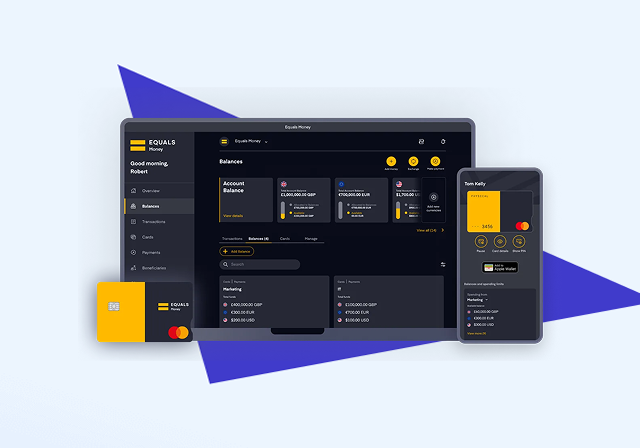

Our expense management platform

Cards: Unlimited virtual & physical

Setup: Instant issuance & control

Equals money streamlines company spending with smart corporate cards, automated invoice management, and real-time budget tracking. No paperwork, no delays—just fast, clear, and scalable financial control for growing businesses.

Advantages:

- Unlimited users on every plan

- Save 17% with annual billing

- Spend in 21 currencies — no FX fees

- Sync with Xero & Concur®

Excellent

-

Popular

Based on the past month

9.8 -

Reputation among entrepreneurs

Based on 700+ Reviews

9.8

Tide

Best for: Growing businesses and startups

APR: 1.2% per month

Speed: Funding in as fast as 24 hours

Tide provides flexible and fast business loans for startups and growing businesses in need of quick capital. Their completely online application process ensures a seamless experience, and you can expect an offer within one business day. With terms ranging from 3 to 12 months, Tide is an ideal option for businesses looking to meet short-term financial needs.

Advantages:

- Quick approval and disbursement

- Flexible repayment options

- Transparent pricing, no hidden fees

Disadvantages:

- Higher interest rates compared to traditional banks

- Short loan term (up to 12 months)

- Available only for businesses with proven turnover

Excellent

-

Popularity

Based on visits in the past 7 days

8.5 -

Brand Reputation

Based on web trends

8.5

Payhawk

Perfect for: Entrepreneurs and self-employed professionals

Price: €750 per month

Payhawk is a modern financial platform focused on simplifying business accounting. It offers tools for managing invoices, quotes, and payments, making it ideal for entrepreneurs and freelancers who need seamless and efficient accounting solutions.

Advantages:

- Automated expense management

- Integration with bank accounts

- Easy invoicing and quote management

- Real-time financial overview

Disadvantages:

- No mobile app available

- Limited customer support hours

Excellent

-

Popularity

Based on visits in the past 7 days

8.4 -

Brand Reputation

Based on web trends

8.4

PLEO

Perfect for: Startups and businesses seeking easy expense management

Price: Flexible pricing based on usage

Pleo is a smart business expense management platform designed to simplify spending tracking and control. Perfect for businesses of all sizes, it provides easy-to-use tools to manage employee expenses with virtual and physical cards, all while ensuring seamless integration with your accounting system.

Advantages:

- Quick and easy online application

- No fixed interest rate

- No startup costs

- Real-time spending monitoring

Disadvantages:

- Limited support for international transactions

- Requires integration with accounting software

Excellent

-

Popularity

Based on visits in the past 7 days

8.2 -

Brand Reputation

Based on web trends

8.2

Capture Expense – A simple and fast solution for business financing.

Best for: Small and medium-sized businesses looking for simple, fast financing

Price: Competitive rates with flexible terms

Capture Expense is designed to help businesses with quick and easy access to capital, offering simple loan terms with no collateral required. With no hidden fees, businesses can focus on growth while easily managing repayments within the maximum loan duration of 36 months.

Advantages:

- No collateral needed

- Fixed and transparent costs

- Flexible repayment plans

Disadvantages:

- 2.95% closing costs may be higher than other options

- Loan duration is capped at 36 months

Excellent

-

Popularity

Based on visits in the past 7 days

8.1 -

Brand Reputation

Based on web trends

8.1

Equals Money PLC Fintech Solutions Inc.

Good for:Small to medium businesses

Approval:Within 48 hours

Equals offers fast and easy financing for small and medium-sized businesses. The application process is completely online and provides instant approval. With flexible repayment terms, it's an ideal solution for businesses that need quick access to capital without the complexities of traditional financing.

Advantages:

- No setup or hidden fees

- Quick online application

- Fast approval process

Disadvantages:

- Limited to businesses with a steady revenue stream

- Higher interest rates for higher risk businesses

Excellent

-

Popularity

Based on visits in the past 7 days

8 -

Brand Reputation

Based on web trends

8

Soldo

Good for: Businesses seeking a simple way to manage employee expenses

Approval: Instant account setup and card issuance

Soldo offers a comprehensive expense management platform for businesses, providing prepaid company cards and detailed expense tracking. The platform is designed to give real-time insights into company spending, helping finance teams streamline their processes. Ideal for companies looking to improve efficiency and control over their expenses, Soldo offers no hidden fees and full transparency.

Advantages:

- Instant card issuance

- Real-time spending insights

- No hidden fees

Disadvantages:

- Limited to certain regions

- Requires business registration